Financial planning is a crucial aspect of life, and for individuals with spinal cord injuries, it becomes even more paramount. The financial burden of a spinal cord injury can be overwhelming, but with the right strategies and support, individuals can navigate these challenges and secure a stable financial future.

The Unexpected Journey

Imagine a life-changing moment that alters your course in an instant. John, a vibrant individual with dreams and aspirations, found himself in such a situation. A sudden spinal cord injury left him grappling not only with the physical challenges but also with the daunting financial implications that followed.

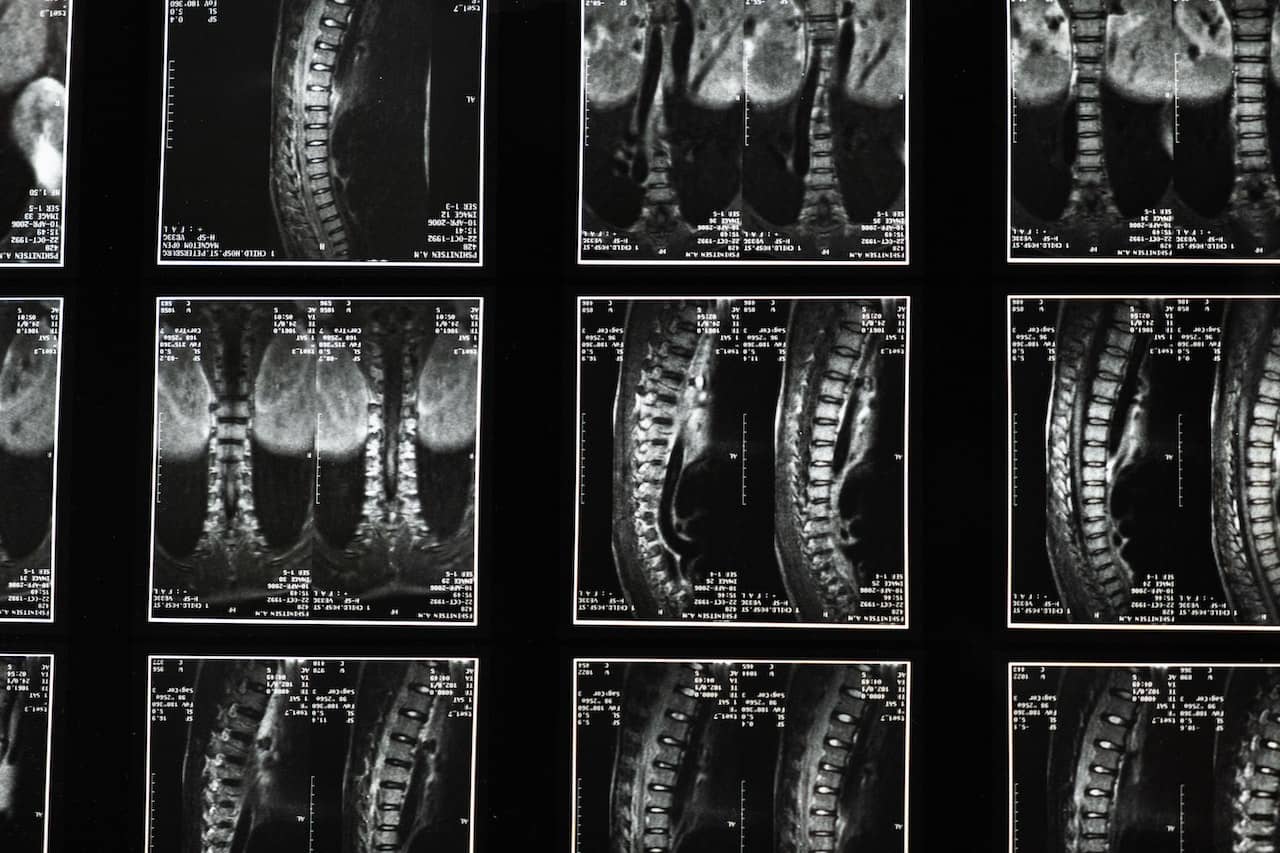

Understanding the Financial Burden

Spinal cord injuries often bring forth a myriad of unforeseen expenses. Medical bills, rehabilitation costs, and adaptive equipment expenses can accumulate rapidly. The financial strain extends beyond immediate needs, affecting daily living and long-term planning. This reality prompts the need for a comprehensive financial strategy tailored to individuals facing these unique challenges.

Coping Mechanisms

So, how do people cope with the financial aftermath of a spinal cord injury? This is a question that many individuals and their families grapple with. The journey begins with acceptance and understanding of the financial landscape ahead. It’s a path that requires resilience, adaptability, and a well-crafted financial plan.

Making a Serious Injury Claim with National Claims

A Partner in Recovery

In the wake of a spinal cord injury, seeking compensation is not just a legal recourse but a vital step in alleviating the financial burden. National Claims understands the unique challenges faced by individuals in such situations. As a partner in recovery, our dedicated team works tirelessly to ensure that individuals receive the compensation they deserve.

Navigating the Claims Process

Making a serious injury claim with National Claims involves a comprehensive and empathetic approach. Our experts guide individuals through the intricacies of the claims process, ensuring that every aspect is handled with diligence. From gathering evidence to negotiating with insurance companies, we stand by our clients every step of the way.

Maximising Compensation

Our commitment goes beyond just filing a claim. National Claims aims to maximise compensation to cover medical expenses, rehabilitation costs, and ongoing care needs. We understand that financial stability is crucial for rebuilding lives, and our team works tirelessly to secure the best possible outcome for our clients.

Crafting a Tailored Financial Plan

Assessing Immediate Needs

The first step in financial planning for spinal cord injuries involves assessing immediate needs. Medical bills, rehabilitation, and necessary modifications to living spaces require immediate attention. It’s crucial to create a budget that addresses these pressing concerns while leaving room for ongoing medical expenses.

Insurance as a Lifeline

Insurance becomes a lifeline in the wake of a spinal cord injury. Health insurance, disability insurance, and other relevant policies play a pivotal role in alleviating the financial burden. Understanding the intricacies of these policies, such as coverage limits and exclusions, is essential to ensure that individuals receive the maximum benefits they are entitled to.

Government Support and Benefits

In the UK, individuals with spinal cord injuries can access various government support and benefits. These resources are designed to provide financial assistance and make the journey more manageable. Navigating the bureaucratic landscape to claim benefits requires diligence, and seeking professional advice can streamline the process.

Adaptive Housing and Transportation

Adapting living spaces and transportation to accommodate the challenges posed by spinal cord injuries is a significant financial consideration. Home modifications, wheelchair-accessible vehicles, and assistive technologies all come with associated costs. A financial plan should include provisions for these adaptations to enhance overall quality of life.

Long-Term Financial Security

Income Replacement Strategies

Maintaining a source of income is crucial for long-term financial security. For individuals unable to return to their previous occupations, exploring alternative income streams or vocational rehabilitation programs becomes essential. Financial planners can assist in identifying sustainable income replacement strategies tailored to individual capabilities and aspirations.

Investment Strategies

Investing wisely is a cornerstone of long-term financial planning. Diversifying investments and considering low-risk options can help protect and grow financial assets. For individuals with spinal cord injuries, conservative investment approaches may be preferable, emphasising stability over high-risk ventures.

Estate Planning

Estate planning is often overlooked but is a vital component of financial security. Creating a will, establishing trusts, and designating power of attorney ensure that financial decisions are managed responsibly in the event of incapacitation. These measures provide peace of mind and protect the financial interests of individuals with spinal cord injuries and their families.

Seeking Professional Guidance

Navigating the intricate landscape of financial planning for spinal cord injuries can be challenging. Seeking the guidance of financial professionals who specialise in disability and rehabilitation planning is invaluable. These experts can provide personalised advice, address unique challenges, and ensure that financial plans align with individual goals.

Conclusion

In the aftermath of a spinal cord injury, the financial journey is as critical as the physical one. Crafting a comprehensive financial plan tailored to the unique needs of individuals with spinal cord injuries is essential for navigating the challenges that lie ahead. From immediate needs to long-term security, every aspect requires careful consideration and strategic planning. Remember, in the face of adversity, a well-thought-out financial plan becomes a beacon of hope, providing the foundation for a resilient and secure future.

Get a start on your claim with the help of one of our claims specialists. Contact us today!

Click below to see why we are one of the most trusted claims management companies in the UK.

We’re proud of our excellent customer reviews

We thrive on delivering exceptional service and ensuring our clients’ satisfaction. Don’t just take our word for it. Check out some of our independent reviews to see what our clients have to say.

Excellent

This firm is excellent, they sorted out my car pay out and injury claim very fast, they always communicate with you all the time.

My accident case was dealt with confidence and with great result of the outcome, especially James kept me informed all the time.

I was very impressed at the way my inquiry was treated. I was listened to attentively and everything I needed to know was explained to me.