Car accidents are unexpected and can be both physically and emotionally taxing. When accidents happen, one of the main concerns for those involved is covering the costs of personal injury claims. In the UK, the system for car crash claims is structured to ensure that those injured in car accidents receive the compensation they need. Understanding who is responsible for paying for these claims, the role of insurance, and what you can expect from the claims process can ease some of the stress that often follows a car accident.

The Road Traffic Accident Claims Process

Once fault has been established, the claims process begins. This involves several steps, all of which will be expertly managed by your solicitor:

- Seek Medical Treatment: It’s important to seek medical attention as soon as possible after an accident. Prompt medical evaluation helps with both your recovery and documentation, providing clear evidence of your injuries for the claim. Your solicitor will ensure that your medical records are obtained and used effectively to support your case.

- Report the Accident: Inform the at-fault driver’s insurance provider as soon as possible. This will typically require submitting documentation like the police report, witness statements, and medical records, all of which serve as essential evidence in your claim. Your solicitor will take the lead in compiling these documents, ensuring everything is submitted correctly and on time, strengthening your case from the start.

- Negotiate a Settlement: In the UK, the vast majority of personal injury claims are settled out of court. According to the Civil Justice Statistics Quarterly: April to June 2024, published by the Ministry of Justice, there were 16,000 personal injury claims during that period. Of these, only a small fraction proceeded to trial, indicating that approximately 2% of personal injury claims make it to the courtroom. Your solicitor will guide you through the settlement negotiation process, using their expertise to ensure that the offer is fair and covers all your expenses, including medical bills, lost income, and any long-term rehabilitation costs.

- Legal Action, if Necessary: If the insurance company’s offer doesn’t fully cover your expenses, you may decide to take legal action to pursue fair compensation. While most car crash claims are resolved outside of court, National Claims will connect you with a solicitor who can determine the strength of your claim and negotiate on your behalf, helping secure the compensation you need.

What Can You Claim for in a Car Crash Claim?

Personal injury claims for car accidents in the UK can cover a wide range of damages. Some of the most common claims include:

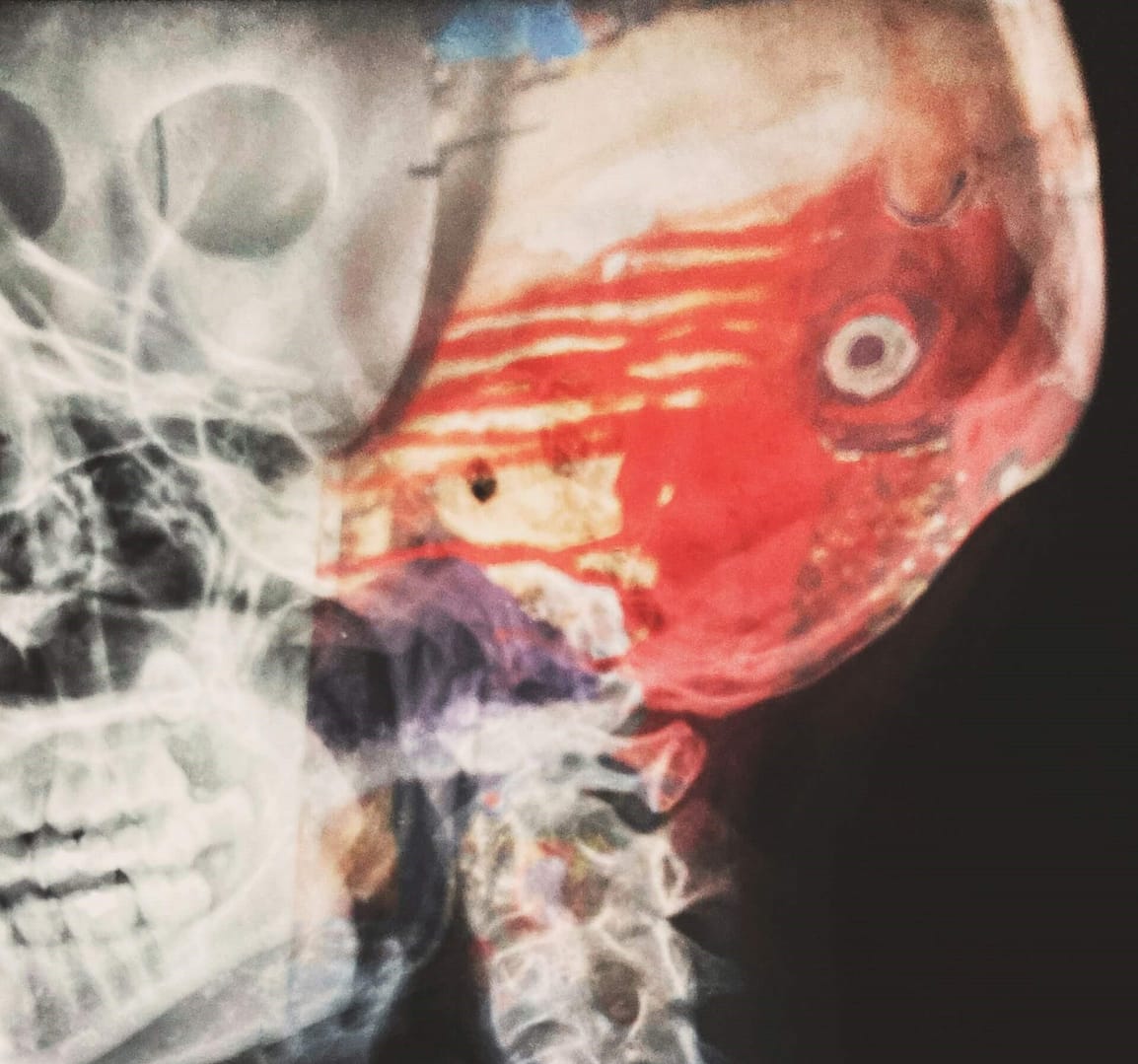

- Medical Expenses: From hospital bills to medication and rehabilitation, medical costs can quickly add up. Your car crash claim can cover these expenses.

- Lost Earnings: If the accident caused you to miss work or has reduced your ability to work in the future, you can claim compensation for lost income.

- Pain and Suffering: This covers the physical and emotional distress caused by the accident, including long-term pain, psychological trauma, and lifestyle impacts.

- Vehicle and Property Damage: Compensation can also include repairs or replacement for your vehicle and any personal items damaged in the accident.

Other Out-of-Pocket Expenses: This can include costs like transportation to medical appointments or help with household tasks that you are unable to perform due to your injuries.

Common Misconceptions About Car Crash Claims : There are several myths surrounding car crash claims, and understanding the truth behind them can help you make informed decisions. Here are a few misconceptions:

- “I Was a Passenger, So I Can’t Claim”: Passengers in a vehicle can make a personal injury claim if they were injured in an accident, regardless of who was driving.

- “Minor Injuries Don’t Qualify”: Even minor injuries that require medical treatment or result in lost work time may qualify for compensation.

People Also Ask

1. Who pays car accident compensation in the UK?

The insurer of the at-fault driver usually pays the compensation. If the driver is uninsured or can’t be identified, the Motor Insurers’ Bureau (MIB) covers the costs.

2. Can I claim if I was partly at fault in a car crash?

Yes, this is called split liability. You may still receive some compensation, but the amount will be reduced based on your share of the blame.

3. What if both drivers are at fault?

If both parties share responsibility, insurers may negotiate a percentage split of liability — like 50/50 — and pay compensation accordingly.

4. How long does it take to get compensation after a car accident?

Most straightforward claims are settled within 4–6 months, but complex or disputed cases can take a year or more.

5. Can I claim for psychological stress after a car accident?

Absolutely. Many people suffer from psychological trauma or stress, and this can be included as part of your personal injury claim.

How Much Compensation Can You Claim?

Compensation varies depending on the severity of your injuries, loss of income, and how much damage was caused.

Here are a few rough guidelines for UK road traffic accident claims:

| Injury Type | Estimated Compensation |

|---|---|

| Minor whiplash | £1,000 – £4,000 |

| Moderate whiplash or soft tissue injuries | £4,000 – £9,000 |

| Serious neck or back injuries | £10,000 – £35,000 |

| Psychological stress or PTSD | £3,000 – £20,000+ |

| Loss of earnings | Based on actual loss |

| Vehicle damage | Cost of repairs or market value |

You can also claim for out-of-pocket expenses like prescription costs, travel to medical appointments, or hiring a replacement vehicle.

To get a more accurate estimate, it’s best to speak with an expert solicitor.

The Role of National Claims in Car Crash Claims

At National Claims, we specialise in helping victims of road traffic accidents secure the compensation they deserve. We understand that dealing with the aftermath of a crash can be overwhelming—especially when you’re injured, dealing with car repairs, or facing financial losses. Our expert team is here to take that burden off your shoulders.

From the moment you contact us, we’ll assess the circumstances of your accident and advise you on the strength of your claim. If we believe you have a valid case, we’ll connect you with a panel of experienced road traffic accident solicitors who work on a no-win, no-fee basis. That means there’s no financial risk to you.

Can You Claim for Car Hire After a Road Traffic Accident?

Yes, you can usually claim for car hire after a road traffic accident, especially if the crash wasn’t your fault. If your vehicle is damaged and off the road, you’re entitled to a like-for-like replacement while yours is being repaired or until you receive a settlement. This cost is typically covered by the at-fault driver’s insurer. If there’s a delay in your claim, many solicitors work with credit hire companies, who’ll provide a vehicle upfront and recover the costs later. Make sure to keep all hire documents and invoices to support your claim. At National Claims, we can help you arrange this with minimal hassle and ensure your mobility isn’t affected while your claim is processed.

Final Thoughts: Seeking Compensation for a Car Crash Claim

If you’re involved in a car accident in the UK, it’s important to understand who is responsible for paying personal injury claims. Generally, the at-fault driver’s insurance will cover your claim, helping you recover from any injuries, lost income, and other costs associated with the accident. In cases of uninsured or hit-and-run drivers, the MIB is there to ensure you receive compensation.

Car accidents can be overwhelming, but having the right support and understanding of the claims process can make a big difference in how you move forward. Working with a solicitor can give you peace of mind, knowing that they will guide you through the process and advocate for the compensation you need to focus on recovery.

Free Consultation with National Claims with No Win, No Fee

If you’ve been involved in a car accident and are thinking about pursuing a personal injury claim in the UK. Contact National Claims today, and we will put you in touch with an expert solicitor who can guide you through the claims process.📞 Call us now free 0800 029 3849 or 📩 Submit an online enquiry to speak to our team.

You’ll only pay if your claim is successful, with up to 25% (including VAT) of the compensation recovered going towards legal fees. This arrangement lets you focus on recovery without the stress of immediate legal expenses. If you decide to cancel after the cooling-off period, a fee may apply, but we ensure you’re fully aware of all terms so you can proceed with confidence.

We’re proud of our excellent customer reviews

We thrive on delivering exceptional service and ensuring our clients’ satisfaction. Don’t just take our word for it. Check out some of our independent reviews to see what our clients have to say.

Excellent

This firm is excellent, they sorted out my car pay out and injury claim very fast, they always communicate with you all the time.

My accident case was dealt with confidence and with great result of the outcome, especially James kept me informed all the time.

I was very impressed at the way my inquiry was treated. I was listened to attentively and everything I needed to know was explained to me.